Benefits of Accident Protect360

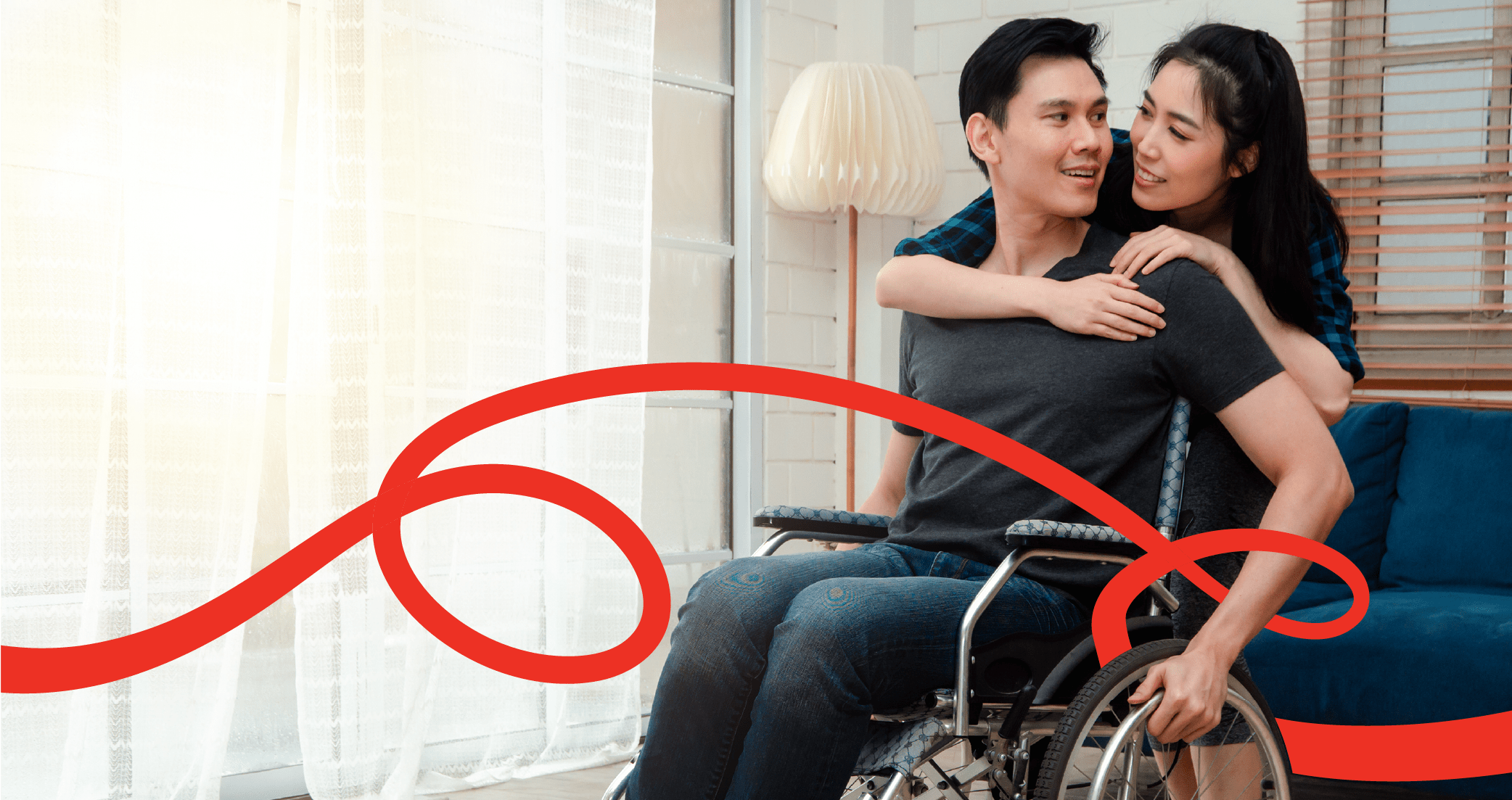

Accident Protect360 is an affordable personal accident protection plan that provides comprehensive coverage worldwide.

Accidental Death or

Disablement

Accidental Medical

Expenses

Mobile Phone and

Credit Card

Outstanding Bills

Income Protector

Why You Should Choose Accident Protect360

Up to 5 benefits with total coverage of up to S$250,000

Accidental Medical Expenses

Receive up to S$1,000 of reimbursement for Accidental Medical expenses including treatment charges by a Chinese Physician in the event of accidents. *Terms Apply.

Mobile Phone and Credit Card Outstanding Bills

In the event of Accidental Death or Total Permanent Disability, get coverage for the Mobile Phone and Credit Card outstanding bills in a lump sum based on your last bill received.

What our customers have to say about us

Sincere and Amazing Service

Customer Review by Sim Kimberly Shu Fern

Thank you so much for the prompt follow up calls and checking on me to ensure everything was well. I appreciate the care and concern shown and the fact that I felt the sincerity of it all just over the phone, shows an amazing service from the heart. This empathy is not easy to come by and to have experienced it from each of you, I can’t say enough what a wonderful team you guys make.

Prompt and Reliable

Customer Review by Tan Yeow Chong

Thank you for providing very prompt and reliable service. As a consumer that is what we are looking forward to, fast, efficient, reliable service that we can trust.

Terms and Conditions

- Voucher is valid from 16th January 2026 to 4th March 2026 (both dates inclusive)

- This voucher has a fixed value of SGD $38.

- Voucher requires a minimum spending of amount greater than SGD $38.

- The voucher may be used multiple times by the recipient.

- The voucher can be applied to the following HL Assurance plans: 1) Travel Protect360 (Multi Trip), 2) Maid Protect360 Pro (26 Months), 3) Home Protect360 (Annual), 4) Family Protect360 (Annual), 5) Hospital Protect (Annual).

- The voucher may only be used on HL Assurance website: www.hlas.com.sg

The voucher may be used in conjunction with ongoing promotions or discounts.

What our Personal Accident Insurance Covers

Key Benefits

- Up to 5 benefits with total coverage of up to S$250,000.

- Up to S$1,000 of reimbursement for Accidental Medical expenses including treatment charges by a Chinese Physician (up to 50% of Benefit payable) in the event of accidents.

- Income Protector pays for your loss of monthly salary/income of up to S$500 per month, maximum total of S$2,000.

Note: Swipe left or right to view the full table on your mobile screen.

| Coverage | Maximum Benefit Payable Currency (S$) |

||

| Premier | Platinum | Diamond | |

| Accidental Death |

|||

| Per Adult | 50,000 | 100,000 | 250,000 |

| Per Child | 10,000 | 20,000 | 50,000 |

| Total Permanent Disablement | |||

| Per Adult | 50,000 | 100,000 | 250,000 |

| Per Child | 10,000 | 20,000 | 50,000 |

| Accident Medical Expenses Reimbursement |

|||

| Per Adult | 500 | 750 | 1,000 |

| Per Child | 100 | 150 | 200 |

| Income Protector | |||

| Per Month | 250 | 250 | 500 |

| Maximum Total Benefit | 1,250 | 1,250 | 2,000 |

| Mobile Phone and Credit Card Outstanding Bills |

|||

| Per Adult | 1,000 | 1,000 | 1,000 |

Policy Owners’ Protection Scheme

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact HL Assurance Pte. Ltd. or visit the GIA or SDIC websites ( www.gia.org.sg or www.sdic.org.sg).

Frequently Asked Questions for Personal Accident Insurance

A: You can apply this Policy if you are between the age of 18 to 65 years old. You must be a Singapore Citizen, Singapore Permanent resident or a foreigner holding a valid pass issued by Singapore government and is residing in Singapore.

A: No. Our policy covers you for injury caused by an Accident. “Accident” means an event which happens suddenly, solely and directly caused by violent and external means and gives rise to a result which the Insured Person did not intend or anticipate.

A: You can find out more about our general exclusions for Accident Protect360 here.

A: In the event of Accidental Death or Total Permanent Disability, this Policy will pay for the Mobile Phone and Credit Card outstanding bills in a lump sum based on your last bill received.

A: No. The Policy premium is not affected by age and does not increase as you get older.

A: No. If you pay the premium and observe the terms and conditions of your Policy, it will be automatically renewed every year.

A: You can submit the claim form, along with the supporting documents by fax to 6224 1923, email to claims@hlas.com.sg or post it to HL Assurance’s office at 11 Keppel Road, #11-01 ABI Plaza, Singapore 089057.

A: Please contact HL Assurance Customer Care Hotline at (65) 6702 0202 (Mon – Fri, 9.00 am – 6.00 pm) or email your questions to service@hlas.com.sg