Ready to discover the unique charm of Taiwan? From the bustling night markets of Taipei to the serene beauty of Sun Moon Lake and the stunning Taroko Gorge, Taiwan offers a wealth of unforgettable experiences. If you’re getting ready to adventure in Taiwan, you should definitely consider travel insurance to protect against unexpected hiccups like flight disruptions, minor accidents while exploring Alishan, or even lost baggage.

What Should Taiwan Travel Insurance Cover?

When considering travel insurance for Taiwan, look for a comprehensive policy that addresses the specific potential risks associated with travel in the region. Here are some key areas to consider:

- Medical Expenses: Ensure coverage for emergency medical treatment if you fall ill while exploring Taipei 101 or require assistance after a scooter accident in Kenting National Park. This should include hospital stays and ambulance services.

- Trip Cancellation and Interruption: Protect your investment in flights and accommodation if you have to cancel your trip due to unforeseen events before you depart Singapore, or if a typhoon disrupts your travel plans while in Taiwan.

- Travel Delays and Missed Connections: Get compensated for extra expenses like hotel stays if your flight from Singapore to Taiwan is significantly delayed, or if you miss a connecting train to Hualien due to transportation issues.

- Lost, Stolen, or Damaged Baggage and Personal Belongings: Claim for the loss of your camera while visiting a night market or if your luggage is damaged during your journey from Singapore to Taiwan.

- Personal Liability: Provides protection if you accidentally cause injury to someone or damage their property, for instance, during a cycling tour in the countryside.

Tailoring Your Travel Insurance for Taiwan

Tailoring your travel insurance for Taiwan is a balancing act between selecting the right coverage for your trip and the budget of your premiums. Here are some things to consider for each type of coverage:

1. Health and Medical Coverage

Getting sick or injured while on holiday in Taiwan can be a real stressful experience. Besides having to navigate an unfamiliar healthcare system in a language you might not know, there is also the additional worry of additional medical expenses on top of your trip.

Look for a policy that includes comprehensive coverage for medical emergencies so you can be adequately covered if they occur. Travel insurance compensation is typically paid to the medical facility where the treatment was received. Remember to thoroughly review the predefined limits and conditions of your policy so you know the exact terms of your coverage.

2. Trip Interruptions and Cancellations

Unexpected events such as severe weather or a sudden health issue can, unfortunately, derail your Taiwan travel plans. Travel insurance with flight cancellation cover, delay and interruption coverage can help recover non-refundable costs like prepaid flights and accommodations. Typically, you’ll be reimbursed if the cancellation or curtailment occurs within 30 days before your trip begins.

Some common reasons for flight delays that are covered by insurance include severe weather, unexpected mechanical issues, or air traffic control problems. However, it’s important to note that standard policies usually don’t cover cancellations due to personal reasons. For greater flexibility in such situations, consider looking for a specific policy feature known as “Cancel for Any Reason”.

3. Personal Belongings and Baggage

When looking at travel insurance coverage for your baggage from Singapore to Taiwan, the most important thing to consider is the value of your belongings and whether the policy’s coverage limits are sufficient.

If you’re traveling with expensive items like a high-end camera or valuable electronics, it might be worth exploring options to increase the standard coverage limits to adequately protect your possessions during your trip.

Also consider how the travel luggage insurance policy handles damage to your belongings and baggage delay. Some policies might not cover damage to high-value items or have specific minimum delay periods before a baggage delay claim is eligible.

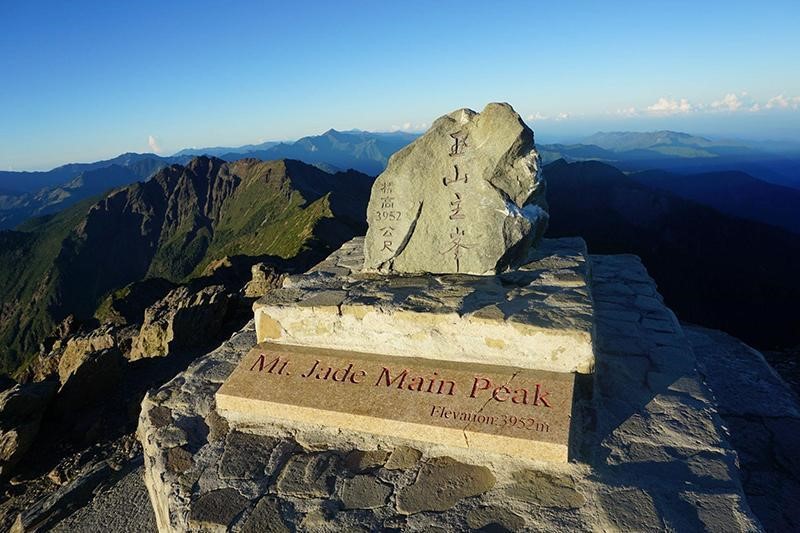

4. Adventure Activity Coverage

Taiwan’s diverse landscapes offer exciting opportunities for adventure activities. If your itinerary includes anything beyond typical sightseeing, such as hiking the trails of Taroko Gorge, horse riding in the countryside, or exploring coastal areas with beach buggy ATVs, then you might want to seriously consider adding adventure activity coverage to your travel insurance policy for Taiwan.

Standard travel insurance often excludes injuries or incidents that occur while participating in these types of activities, leaving you potentially responsible for significant medical or other related costs. When looking at adventure activity coverage, carefully review the list of activities covered by the policy to ensure it aligns with your planned adventures in Taiwan. Some policies might have exclusions for specific high-risk sports.

Choosing the Right Policy for Your Taiwan Adventure

When planning your Taiwan adventure, it’s crucial to find a travel insurance policy that not only fits your budget but also covers all your planned activities. Whether you’re planning to navigate the vibrant streets of Taipei or embark on scenic hikes, your insurance should cater to these specific experiences. Delve into the details of each policy, keeping an eye out for any exclusions that could affect you, and familiarise yourself with the claims process.

This approach ensures that you choose a policy that provides both financial feasibility and comprehensive coverage, making your Taiwanese journey worry-free.

How to Claim Your Travel Insurance in Taiwan

Claiming your travel insurance through HL Assurance in Taiwan is a straightforward process. If an incident occurs, follow these steps:

- Step 1: Contact HL Assurance as soon as an incident occurs.

- Step 2: Gather all necessary documents, such as your passport, insurance information, medical reports or police statements.

- Step 3: Complete and submit the claim form with the required documents.

Frequently Asked Questions About Taiwan Travel Insurance

Is it worth getting travel insurance for Taiwan?

Absolutely. While Taiwan is a popular and generally safe destination, unexpected events—like medical emergencies, travel delays, or lost luggage—can happen. Having travel insurance for Taiwan ensures you’re financially protected, allowing you to explore with confidence and ease.

Is Taiwan a safe country to visit?

Yes, Taiwan is considered one of the safest countries in Asia for tourists. That said, it’s still wise to remain cautious in crowded areas and stay informed about any weather advisories, particularly during typhoon season. Comprehensive travel insurance offers added protection in case of emergencies.

Do I need a visa when travelling to Taiwan?

Singapore passport holders can enter Taiwan visa-free for up to 30 days for tourism purposes. However, visa policies can change, so it’s always good to verify entry requirements before your trip.

Do I need vaccinations?

Taiwan does not require mandatory vaccinations for entry, but it’s advisable to be up to date on routine vaccines like Hepatitis A, Hepatitis B, Typhoid, and COVID-19. Consult your doctor or a travel health clinic for personalised advice based on your itinerary.

What’s the best time of year to visit Taiwan?

The best times to visit Taiwan are during spring (March to May) and autumn (September to November), when the weather is mild and pleasant. If you’re travelling during typhoon season (typically June to October), consider getting travel insurance that covers common reasons for flight delays, such as severe weather disruptions.

Choose HL Assurance for Your Taiwan Travel Insurance

Set off for Taiwan with HL Assurance, and enjoy the island’s delights knowing you’re protected and supported with comprehensive coverage. HL Assurance’s range of insurance options and efficient claims process ensures that your trip will be an enjoyable and stress-free one.

Disclaimer: All info contained herein is intended for your general information only and is not a substitute for travel insurance advice. If you have a specific question, please consult our insurance experts at 6702 0202.