Enjoy More Chances When You Spend More!

CURRENT HOSPITAL INCOME INSURANCE PROMOTION

Why You Should Choose Our Hospital Income Insurance?

Enjoy up to $300 daily cash benefits in the event of hospitalisation – and free COVID-19 cover – only with our affordable Hospital Protect360 insurance.

We provide additional benefits to let you recover with peace of mind.

Recuperation Benefit

You may need time off work to focus on recovery after hospitalisation. Get up to $100 daily hospital income benefit to ease some of your financial burdens so that you can relax and focus on your recovery.

20% No Claim Bonus

Get rewarded for staying safe for the full year! If you do not make any claims from your Hospital Income Insurance Plan, you will enjoy up to 20% No Claim Bonus when you renew your hospital income policy!

Benefits of Hospital Income Insurance

Bills don’t stop when you need a break. Get the financial boost you need during hospitalisation to ease your worries with our Hospital Protect360.

Daily Hospital Income

Special COVID-19

Benefit

Ambulance & Transportation

Allowance

20% No Claim

Bonus

Other Promotions

HL Bank Debit Card

HL Bank Debit Card Travel Insurance Promotion

Get up to $30 voucher when you sign up for COVIDSAFE Travel Protect360 and pay with HL Bank Debit Card.

Why you should choose Hospital Protect360 Insurance

Excellent Service and Fast Response

Customer Review by Mohamad Ishak Bin Hamzah

Excellent service and fast response from you. At the moment, I will extend my recommendation to my friends or relative with much confidence and without any doubt. Keep up your good performance and to maintain for long run customer.

Highly Trained

Customer Review by Nicholas Tan

I’d like to compliment the good and helpful service shown to me when I called up the hotline. You’ve shown that you’re highly trained and able to address my queries and concerns quickly so that I can settle this administrative procedure smoothly.

- Hospital Protect360 Promotion is valid from now until 30 September 2024.

- The promotion is only valid for new customers who purchase any Hospital Protect360 Insurance policy, will be entitled to the below promotions:

Plan Type Payment Type Discounts Single Monthly 0% Annual 5% Couple Monthly 5% Annual 10% - HL Assurance may vary the Terms and Conditions of this Promotion without prior notice of withdraw or discontinue the Promotion at any time without any notice or liability to you.

- HL Assurance at any time, at its sole discretion and without prior notice; can vary, modify, delete or add to these terms and conditions. Please refer to the policy wordings and policy schedule for full details.

- In the event of any dispute, HL Assurance management’s decision is final.

- HL Assurance full disclaimers, terms and conditions apply to individual products. © 2024 HL Assurance is registered service mark of Hong Leong Group. HL Assurance Private Limited Co. Reg. No. 201229558W.

- “HL Assurance” means HL Assurance Private Limited.

- HL Assurance’s Hospital Protect360 is underwritten by HL Assurance Pte. Ltd. Co. Reg. No. 201229558W. This policy is protected under the Policy Owner’s Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact HL Assurance Pte. Ltd. or visit the GIA or SDIC websites (www.gia.org.sg or www.sdic.org.sg). This is not a contract of insurance. Accordingly, the information should be read and construed in the light of, and subject to, all terms and conditions contained in the Policy. Full details are stated in the Policy.

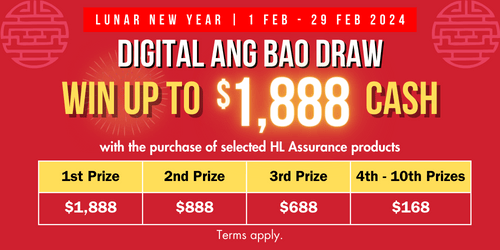

Please click the link for terms and conditions: Lunar New Year Digital Ang Bao Draw 2024 Giveaway Terms and Conditions

The Key Benefits of our comprehensive hospital income plan are:

- Special COVID-19 payout for positive diagnosis with ICU hospitalization.

- Receive Triple payout of up to $900 per day in the event of hospitalization due to injury or sickness.

- Post hospitalization Recuperation care benefit to allow you to rest with a peace of mind.

- Refund of 20% of premiums paid back should there be no claims for the year.

Note: Swipe left or right to view the full table on your mobile screen.

| Sections | Coverage | Maximum Benefit Payable Currency (S$) |

||

| Silver | Premier | Titanium | ||

| 1 | Daily Hospital Cash per day up to 365 days | 100 | 200 | 300 |

| 2 | Triple Hospital Cash (in ICU) per day up to 30 days | 300 | 600 | 900 |

| 3 | Recuperation Benefit per day up to 30 days | 50 | 75 | 100 |

| 4 | Special COVID-19 Benefit | 10,000 | 10,000 | 10,000 |

| 5 | Ambulance and Transportation expenses | 500 | 500 | 500 |

| 6 | No Claim Bonus | 20% | ||

Policy Owners’ Protection Scheme

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact HL Assurance Pte. Ltd. or visit the GIA or SDIC websites ( www.gia.org.sg or www.sdic.org.sg)

Frequently Asked Questions for Hospital Protect360 Insurance

You can apply this Policy if you are between the age of 18 to 65 years old. You must be a Singapore Citizen, Singapore Permanent resident or expatriate or a foreigner who is holding a valid employment pass, work permit, dependent pass, student pass or long term visit pass and ordinarily residing in Singapore.

A: No, you can only claim under either Section 1 or 2 for the same day of hospitalization due to an accident or illness.

A: In the event that you sustain an injury or illness during the period of insurance and is considered medically necessary by a Medical Registered Practitioner that you will be hospitalised to receive in-patient treatment.

For each injury and illness:

- Up to 365 days under Section 1 – Daily Hospital Cash or

- Up to 30 days under Section 2 – Triple Daily Hospital Cash (in ICU) benefit.

A: Yes, you are covered while you are overseas.

If you are away from Singapore, it shall be a period of not more than one hundred and eighty-three (183) days during the Period of Insurance.

A: Yes, the premium will increase upon renewal of the policy, if the insured’s age during renewal entered into the next age band.

A: No, rehabilitation centre and community hospitals do not meet the definition of a hospital under the policy which means an institution lawfully operated for the care and treatment of injured or sick persons with organized facilities for diagnosis and surgery, having twenty-four (24) hours per day nursing services by legally qualified registered nurses and medical supervision under Registered Medical Practitioners.

A: There is a waiting period of 30 days from the effective date of your policy for claims that are due to illness. There is no waiting period if the claim is due to injury because of an accident.

A: If no claim has been made under this policy after twelve (12) consecutive months, we will refund you 20% of the premium that you have paid at the end of each annual period. Provided that:

- There has been no interruption of cover for a period of twelve (12) consecutive months.

- Premium has been fully paid.

A: The benefit pays you up to the benefit limit if you are diagnosed with COVID-19 during the Period of Insurance and is considered medically necessary by a Registered Medical Practitioner that:

- You will be confined in an Intensive Care Unit (ICU) in a Hospital for more than five (5) days, or

- In the event of your death as a direct result of contracting COVID-19.

Q: Am I allowed to change my hospital income insurance plan type, i.e. upgrade or downgrade my plan?

A: You may choose to upgrade your plan type upon the annual renewal of your policy, subject to approval.

A: For Section 1 to 4, the benefits are payable on top of other insurance policies that you have, subject to each benefit limit.

A: You can submit the claim form, along with the supporting documents by fax to 6224 1923, email to claims@hlas.com.sg or post it to HL Assurance’s office at 11 Keppel Road, #11-01 ABI Plaza, Singapore 089057.

A: Please contact HL Assurance Customer Care Hotline at (65) 6702 0202 (Mon – Fri, 9.00 am – 6.00 pm) or email your questions to service@hlas.com.sg. Our relationship officers will be happy to assist you.

A: You can find out more about our general exclusions for Hospital Protect 360 here.

A: You can find out more about the Terms and Conditions for Hospital Protect360 here.